Gale Academic OneFile - Document - Methods of measurement and benchmarking of VAT gap in the European Union

Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research

Case studies on the real-world challenges of VAT reform (Part III) - The Rise of the Value-Added Tax

![PDF] Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | Semantic Scholar PDF] Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/7d7fee73449e260d9bfe442a7bf89dd486ac2845/28-Figure3-1.png)

PDF] Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | Semantic Scholar

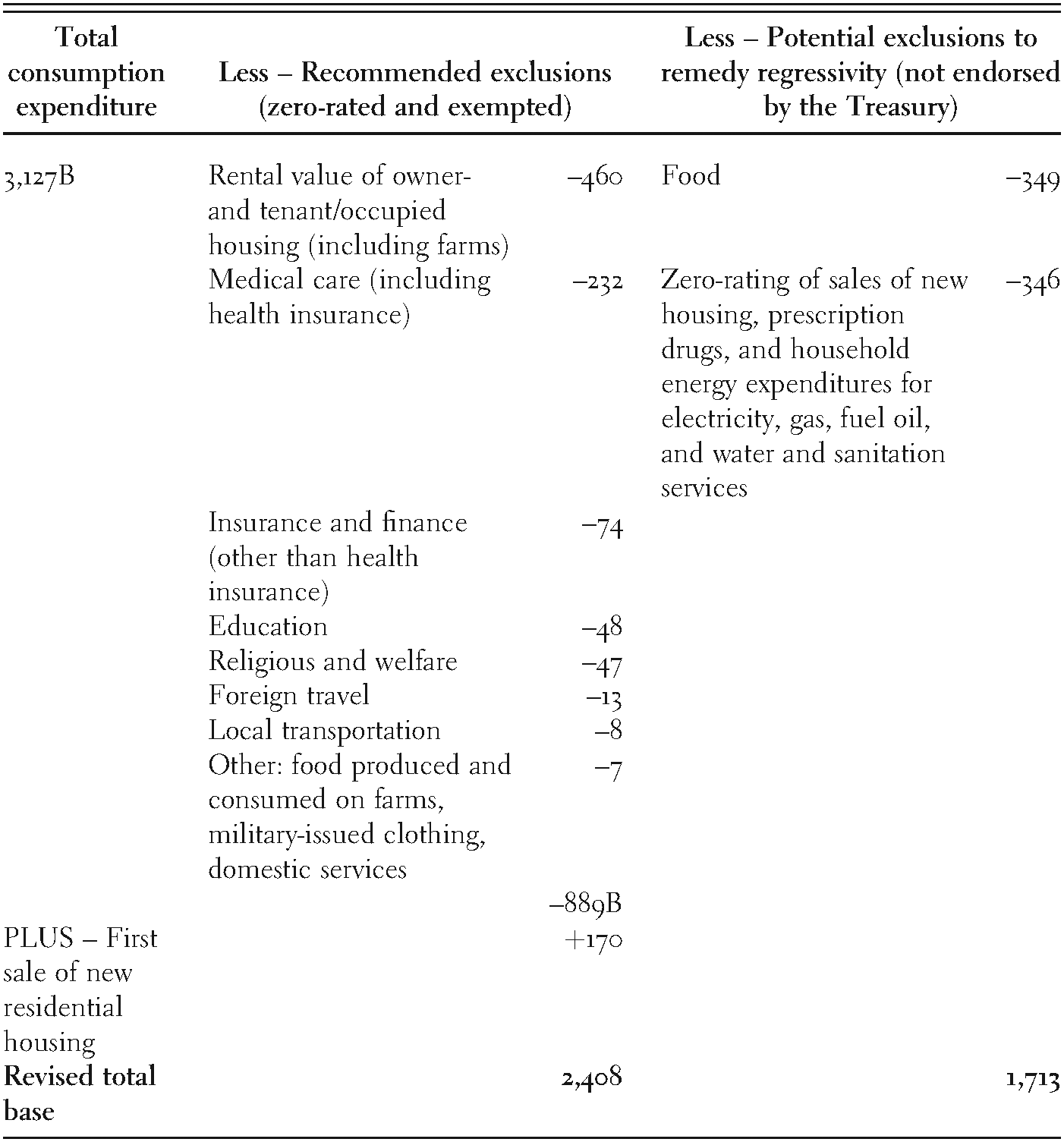

![PDF] Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | Semantic Scholar PDF] Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/7d7fee73449e260d9bfe442a7bf89dd486ac2845/20-Table3-1.png)

PDF] Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | Semantic Scholar

CHAPTER 2 LITERATURE REVIEW | Performance Measurement and Evaluation of Tolling and Congestion Pricing Projects | The National Academies Press

Collection Dilemmas and Performance Measures of the Value-Added Tax in Germany and Poland in: International Journal of Management and Economics Volume 54 Issue 2 (2018)