トミーヒルフィガー TOMMY HILFIGER TAYLOR-HOBO XBODY-REC SMTH NYLON (ネイビー) -waja bazar - 海外ファッションブランド通販サイト【公式】

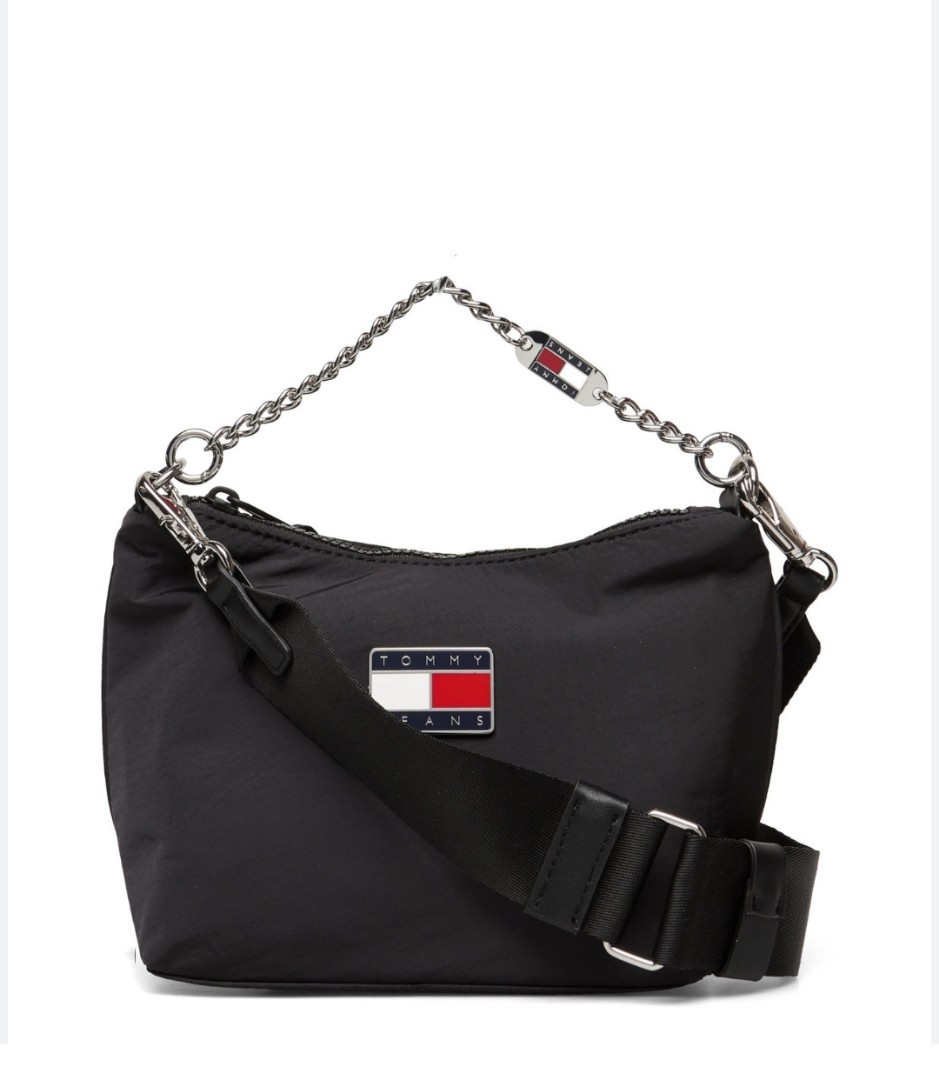

Black Shoulder bag TJW SUMMER NYLON SHOULDER BAG Tommy Hilfiger, Women Crossbodies black Shoulder bag TJW SUMMER NYLON SHOULDER BAG Tommy Hilfiger, Women Crossbodies | Denim Dream e-store

2712☆ TOMMY HILFIGER トミーヒルフィガー トートバッグ 肩かけバッグ レディース ライトブラウン detalles del artículo | Servicio proxy de pujas y pedidos para subastas y sitios web de Japon y los Estados Unidos - Obtenga las