AGT Lötkolben Sets: Digitale Lötstation mit LCD-Display, 160-520 °C, 48 Watt (Lötstation Elektronik) : Amazon.de: Baumarkt

AGT Lötgerät: Digitale Premium-Lötstation mit elektronischer Temperatur-Steuerung (Profi Lötstation) : Amazon.de: Baumarkt

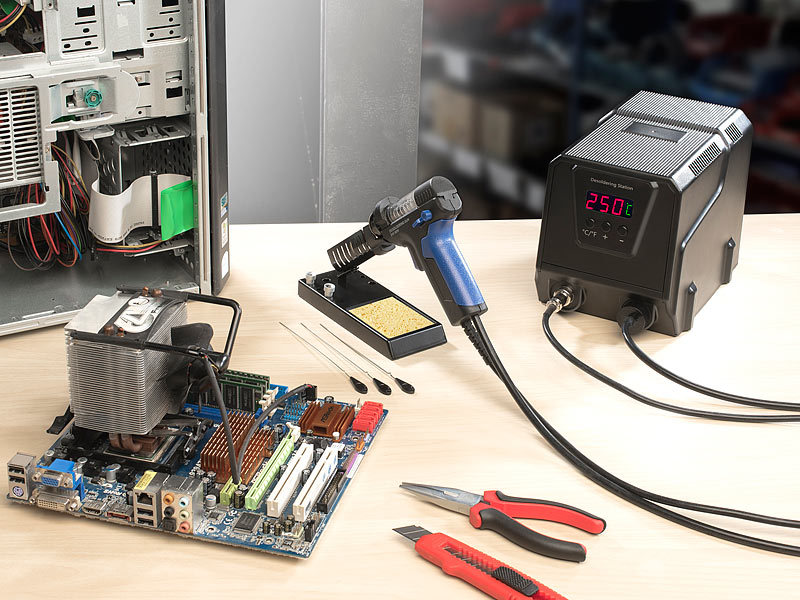

AGT Lötstation: Digitale Profi-Entlötstation mit Vakuum-Pumpe, 160 - 480 °C, 200 Watt (Entlötpistole)

AGT Lötgerät: Digitale Premium-Lötstation mit elektronischer Temperatur-Steuerung (Profi Lötstation) : Amazon.de: Baumarkt

Präzisions-Lötstation mit Fein Lötkolben 230V, 8W, regelbar von 100-425C° ideal für Kleinreparaturen : Amazon.de: Baumarkt

Komerci regelbare Mini Lötstation Lötkolben ZD-928 12V 8W mit Nadelspitze Feinlötkolben Lötnadel, hellblau/schwarz : Amazon.de: Baumarkt

AGT Lötgerät: Digitale Premium-Lötstation mit elektronischer Temperatur-Steuerung (Profi Lötstation) : Amazon.de: Baumarkt

AGT Lötgerät: Digitale Premium-Lötstation mit elektronischer Temperatur-Steuerung (Profi Lötstation) : Amazon.de: Baumarkt

AGT Lötstation: Digitale Profi-Entlötstation mit Vakuum-Pumpe, 160-480 °C, 200 Watt (Löten) : Amazon.de: Baumarkt

AGT Lötstation: Digitale Profi-Entlötstation mit Vakuum-Pumpe, 160-480 °C, 200 Watt (Löten) : Amazon.de: Baumarkt

AGT Lötgerät: Digitale Premium-Lötstation mit elektronischer Temperatur-Steuerung (Profi Lötstation) : Amazon.de: Baumarkt