balenciaga triple s größe 38 curry beige green yellow grün gelb in Thüringen - Mühlhausen | eBay Kleinanzeigen

Balenciaga Tripple S Sneaker NEON GRÜN in 2514 Gemeinde Traiskirchen für 280,00 € zum Verkauf | Shpock DE

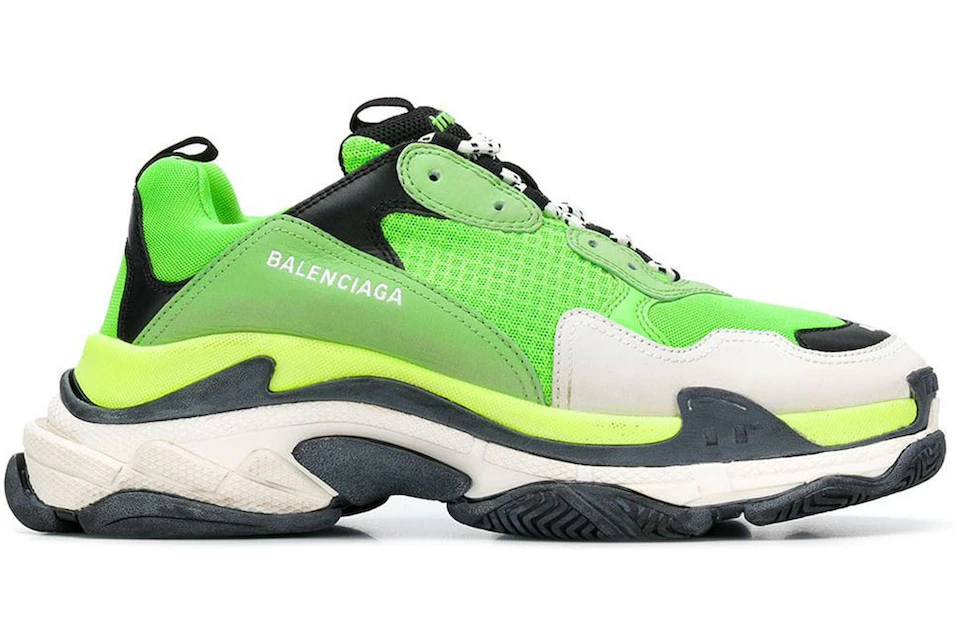

Grün Triple S Clear Sole Sneakers aus Kunstleder und Mesh mit Logostickerei | BALENCIAGA | NET-A-PORTER

Balenciaga Leder Sneaker low TRIPLE S Kalbsleder Lammleder Polyester Logo beige gelb grau grün schwarz in Natur für Herren | Lyst DE

Balenciaga Tripple S Sneaker NEON GRÜN in 2514 Gemeinde Traiskirchen für 280,00 € zum Verkauf | Shpock DE

balenciaga triple s größe 38 curry beige green yellow grün gelb in Thüringen - Mühlhausen | eBay Kleinanzeigen