BRANDS A TO Z: adidas BOOK(History, products, advertising, marketing, branding) 9784861005374 | eBay

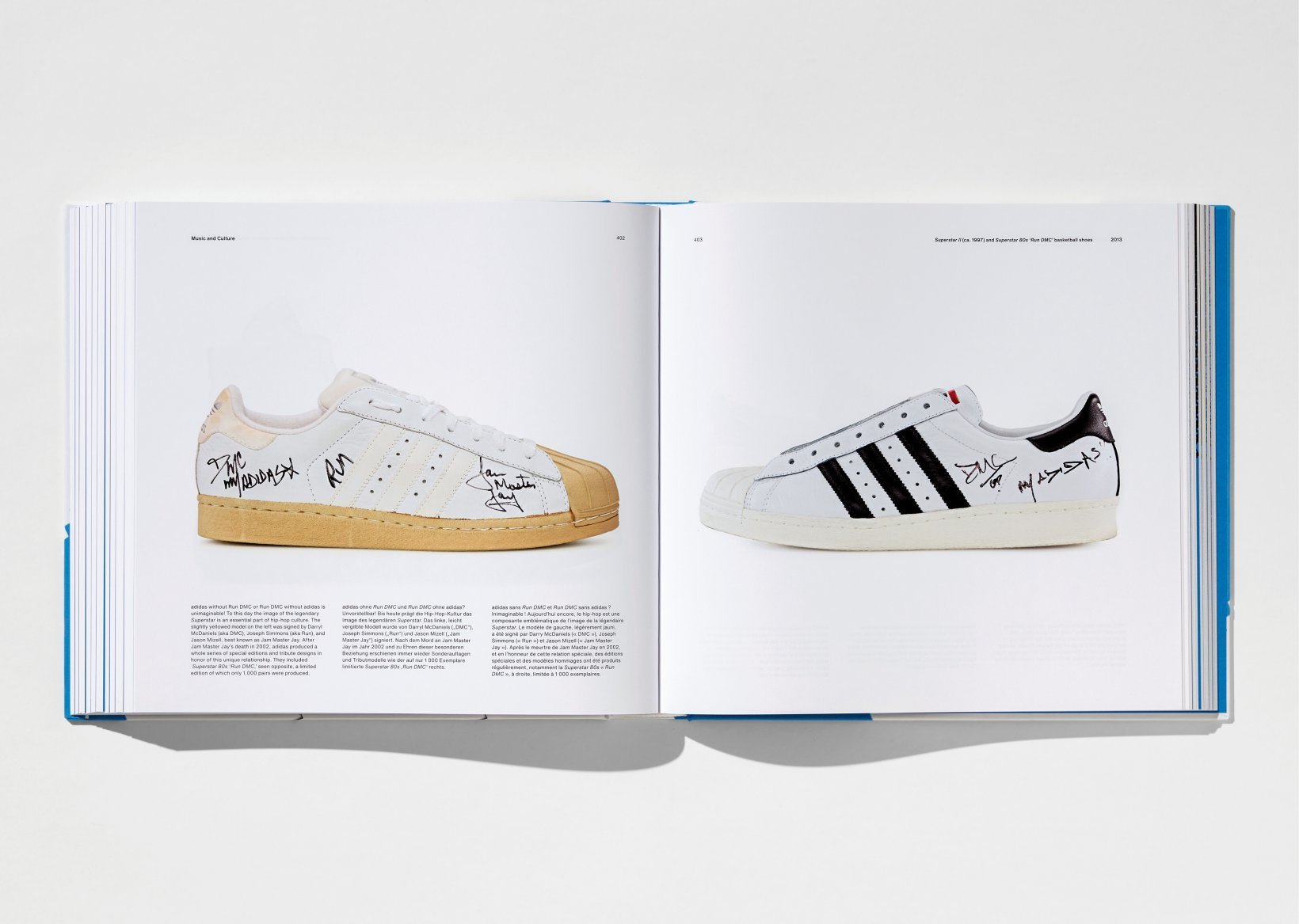

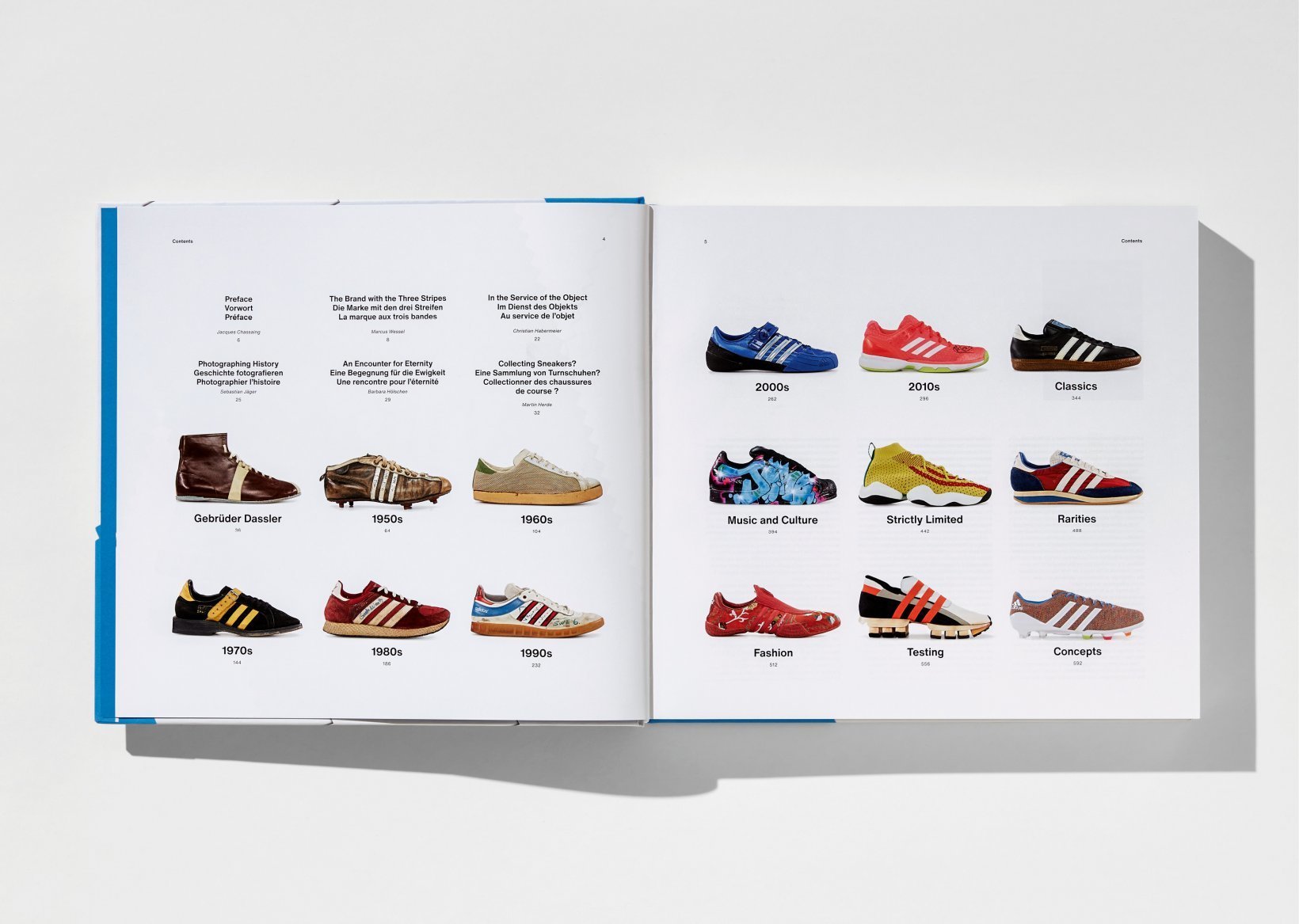

A Visual History of Sneaker Design: "The Adidas Archive" Book Documents 350+ Pairs of Kicks - Core77

Amazon.co.jp: Sneaker Wars: The Enemy Brothers Who Founded Adidas and Puma and the Family Feud That Forever Changed the Business of Sports : Smit, Barbara: Foreign Language Books