Amazon.com: Under Armour Men's ColdGear Armour Leggings (Large, Black/Graphite - 001) : Clothing, Shoes & Jewelry

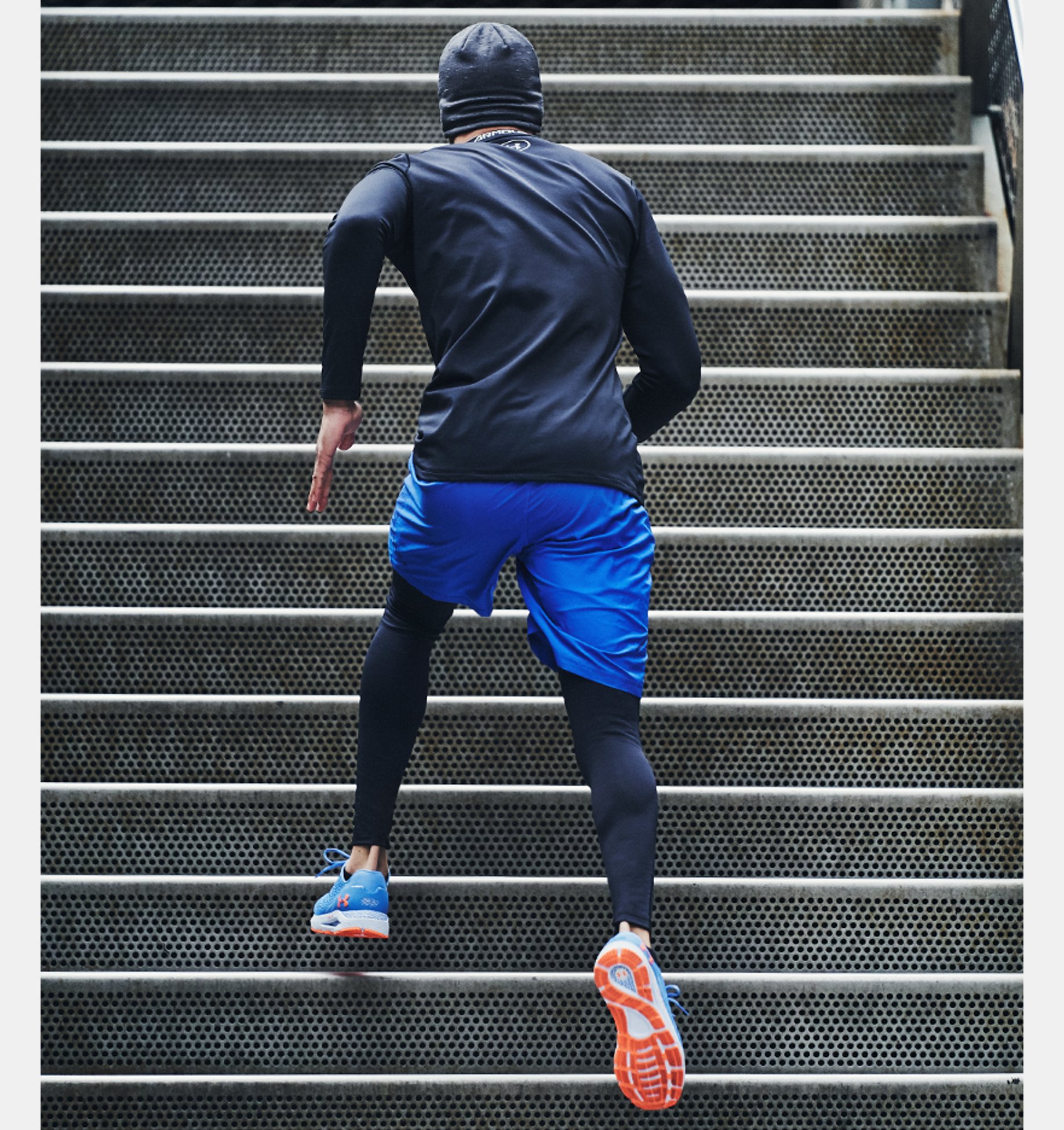

Amazon.com : Under Armour Men's ColdGear Armour Leggings , Black (001)/White, Small : Clothing, Shoes & Jewelry

Amazon.com : Under Armour Men's ColdGear Armour Compression Leggings, White (100)/Steel, Small : Clothing, Shoes & Jewelry

Amazon.com : Under Armour Men's ColdGear Armour Compression Leggings, White (100)/Steel, Small : Clothing, Shoes & Jewelry